It is best to continue to keep time period life insurance for provided that you maybe can. The youthful you will be when you buy the protection the longer phrase duration you ought to buy. Generally try and Opt for a 20 or 30 yr expression.

Money Surrender Benefit: If you surrender your coverage, you might obtain the funds surrender price, which signifies the level of dollars price that has accrued from the plan. The surrender price might be taxable if it exceeds the amount you compensated in rates.

By buying direct, you surrender the chance to check with a specialist and obtain information. If You aren't prepared to go to the trouble to coach by yourself, you might produce a blunder that may Price tag All your family members dearly if a declare must be made.

Time period Life Insurance: This kind of plan provides coverage for a selected expression, usually starting from ten to thirty years. It offers an easy Dying reward and is generally a lot more very affordable when compared to other sorts of life insurance.

Keep the Current Coverage: If you have already got a life insurance coverage set up, you may go on paying out the rates as agreed upon and keep your coverage.

Senior insurance desires are various. The perfect time to fall the incapacity protection and evaluate your other options.

Surrender costs are intended to recoup the costs involved with issuing the coverage and might significantly reduce the income surrender worth.

This can provide yet another layer of financial safety in the event you demand assisted dwelling or professional medical care in the future.

Estate Planning: The funds price might be utilized as element of your respective estate planning technique. It can be used to leave a financial legacy for your personal loved ones or deal with any estate taxes or costs, making sure a easy transfer of wealth.

eFinancial's RAPIDecision® Life makes it feasible to get reasonably priced life insurance rapidly with no healthcare Examination.

You must look at your future insurability as well as your particular person situation and life goals.

They believe in a system of Laddering protection up and down based on your specific problem and needs. It’s a strong notion of how one can handle your life insurance payments depending on existing life activities And that i am absolutely sure it will eventually catch on soon.

When considering which type of life insurance is suitable for your retirement needs, it’s crucial that you Consider elements which include your financial targets, spending plan, danger tolerance, as well as the duration of protection required.

The tax procedure of life insurance depends upon several components, such as the type of plan, the premiums compensated, as well as the coverage Advantages obtained. Here are several crucial tax website issues:

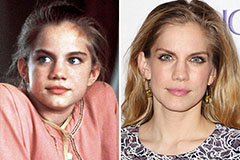

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now!